Halal car finance: interest-free finance options

Halal car finance – or Islamic car finance – can spread the cost of a car with no interest being charged, but there are other costs.

Islamic – or Halal – car finance is a way of spreading the cost of a new or used car that’s compatible with the faith, allowing drivers to access car finance deals while adhering to Islamic restrictions on money-lending with interest and speculation.

But what many people don’t realise is that Halal car finance isn’t measurably cheaper than other ways of financing a car, such as PCP finance.

Rather than charge interest on a loan or finance package, Halal finance sees any additional costs to the provider levied upfront – the cost of lending is added to the cost of purchase, to then provide an interest-free loan that complies with Halal protocols.

In some cases, Halal car finance can actually work out more expensive overall and you’re often required to pay a larger initial deposit. Therefore, it’s worth considering which type of finance best suits your faith and budget. As a general rule, you will get fewer choices with Halal finance.

How does Halal car finance work?

Halal car finance almost always takes the form of a personal loan. The lender buys the vehicle from a seller and then sells it to the customer using pre-agreed monthly payments over an agreed period of time. The purchase price of the car is the total amount of the loan, with no additional interest.

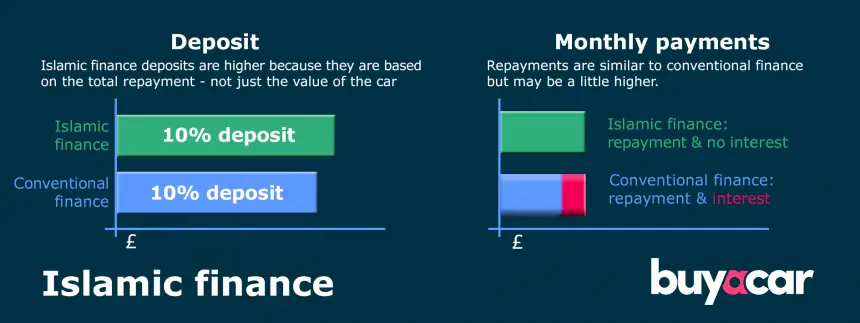

To cover this, lenders will increase the price of the vehicle to cover the cost of lending. As the initial price of the car is higher, the deposit required is also larger, as finance often features a minimum deposit that is typically a proportion of the car’s value.

Is PCP car finance Halal?

Critically, the option of PCP Finance (Personal Contract Plan) is not available with Halal car finance. This is typically the most flexible and affordable type of car finance, with low deposits and monthly payments compared with the value of the car. You can also buy the car outright at the end of the contract by making a large optional final payment.

So it’s worth considering which type of finance fits your needs better. Yes, some finance arrangements include the cost of borrowing money in the form of interest, which may not be compatible with Islamic faith.

However, you will still be charged a premium for borrowing money with Halal car finance, because the premium is typically bundled in with the purchase price of the car and not shown separately.

Is car leasing Halal?

One alternative that doesn’t involve interest is car leasing. This is effectively a form of long-term car rental and no interest is charged, as you’re not borrowing money for the car but paying a monthly amount.

At the end of the contract, which typically lasts two to four years, you simply return the car.

Leasing and 0% APR contracts both set out how much you’ll pay in monthly payments over the course of an agreement and guarantee customers won’t face further charges if the car loses value faster than expected during the agreement. It’s therefore worth looking into these options to see if they suit your faith.

Penalty fees can be imposed with leasing, though, if the car is returned with damage beyond fair wear and tear or mileage above the pre-agreed mileage limit.

Late payment charges apply if you miss payments, too, with interest likely to be charged on the outstanding debt. An Islamic bank would normally pass these payments to charity to avoid receiving interest, although charges may still be issued.

If you’re looking for a new car, then leasing may suit your faith, particularly if you only want to run a car for a couple of years and then hand it back. Monthly payments can be even lower than with a PCP contract.

Is Hire Purchase (HP) finance Halal?

Hire Purchase (HP) finance enables you to spread the full cost of a car across a deposit and a series of fixed monthly payments. At the end of the contract, you’ll own the vehicle.

Halal HP finance isn’t widely offered, but interest-free credit Hire Purchase can be offered on new cars. The way that Halal finance works is similar, because you make fixed monthly payments that cover the entire cost of the car and for borrowing the money, and you are the owner of the car at the end of the contract.

Monthly payments for conventional Hire Purchase finance are calculated by dividing the cost of the car (£20,000 for example), minus any deposit, by the number of instalments.

Interest is added to the result (apart from in the case of interest-free credit offers), resulting in fixed payments for the entire term. If the total cost of interest were to add up to £2500, then you would end up paying £22,500 in total.

Halal finance is different as it is based on the value of the car, plus the cost of supplying credit. If the total cost of the car and the credit were the same as the car above, that could add up to £22,500. The difference is that the £22,500 would then become the price of the car and you’d then repay this amount in equal monthly instalments, with no formal interest being charged.

Deposits are usually slightly higher with Halal car finance as you’ll normally need to put down a certain percentage of the car’s initial value for the cheapest deals.

Does BuyaCar offer Halal car finance?

No, BuyaCar does not offer Halal finance directly, but it is possible to buy a nearly new or used car from the site using Halal finance that has been arranged separately.

Alternatively, it is possible to pay monthly for a new car without paying interest as many new cars are available with 0% APR finance – which is effectively interest-free.

In doing so, though, you will be paying more for a brand-new car, financed or otherwise, compared to even a one-year-old equivalent.

You may not be paying interest with a 0% APR deal, but as new car cash prices are typically much higher than used alternatives, even interest-free finance on a new car can involve much higher monthly payments than other finance options on a used car, including independently sourced Halal car finance.

Also, don’t think that 0% APR finance deals offer better value than alternatives that charge interest, as deposit contribution discounts aren’t taken into account in APR figures. It’s sometimes possible for these discounts to outweigh the amount of interest charged.

Depending how you approach your faith, this may affect which finance options you want to consider.

Getting a good deal with Halal finance

As with conventional car finance, the cost of your monthly payments under Halal finance will vary depending on the car you choose and your credit rating – so it’s always worth shopping around to make sure that you’re getting the best deal.

If you’re in a steady job with a good income, then you’re likely to be seen as a low-risk borrower, which can increase your chances of being accepted for the best value finance options and may reduce your monthly payments.

Putting down a large deposit will also cut your instalments, because you’re borrowing less.