What happens at the end of a PCP finance agreement?

Coming to the end of your PCP finance deal and not sure what happens next? Keep reading to find out your options

PCP finance gives you several options at the end of the contract - letting you purchase the car for a pre-agreed amount, hand it back or trade it in for a new one.

Working out the best option isn't always that simple though. Are you better off returning the car and walking away or paying to keep it? Should you trade in the car or refinance? And how do you avoid damage and excess mileage charges if you do hand the car back?

There are several different end-of-contract scenarios with PCP finance, depending upon whether you want to keep the car, trade it in for another model or hand it back to the finance company and walk away.

You have three options:

Buy the car You’ll need to pay an additional lump sum, known as the optional final payment, which was agreed at the beginning of the term. This can be refinanced.

Trade in for a new car It’s possible to trade in the car for a new one with many dealers. If the dealer deems the car worth more than the optional final payment, there will be a surplus that you can put towards the deposit on your next car, reducing future monthly payments.

Return the car Return the car to the lender and you’ll have no more monthly payments to make, although charges for damage and exceeding the pre-agreed mileage limit may be issued. If the car is worth more than the optional final payment, you will probably be better off making that payment to buy it and then selling it privately.

How PCP works

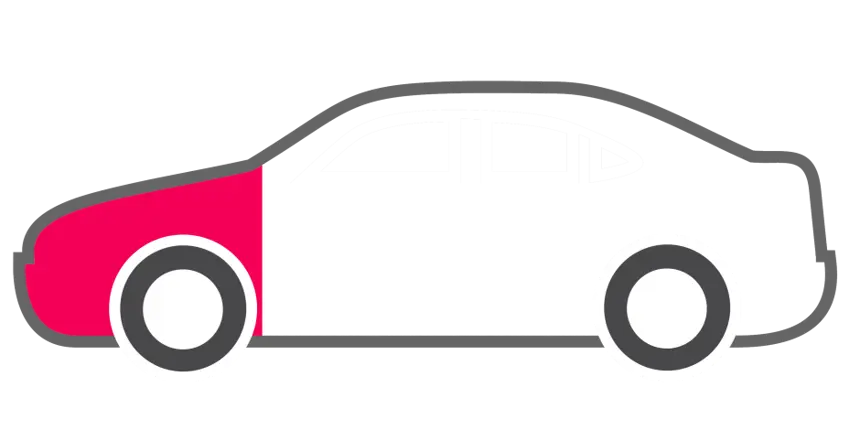

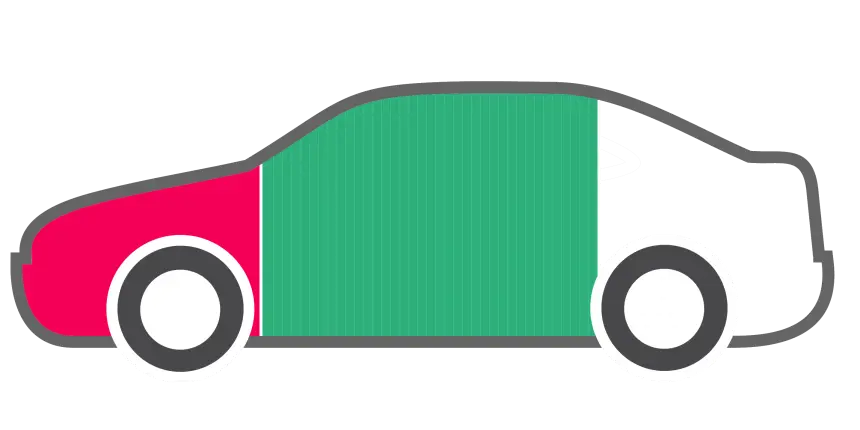

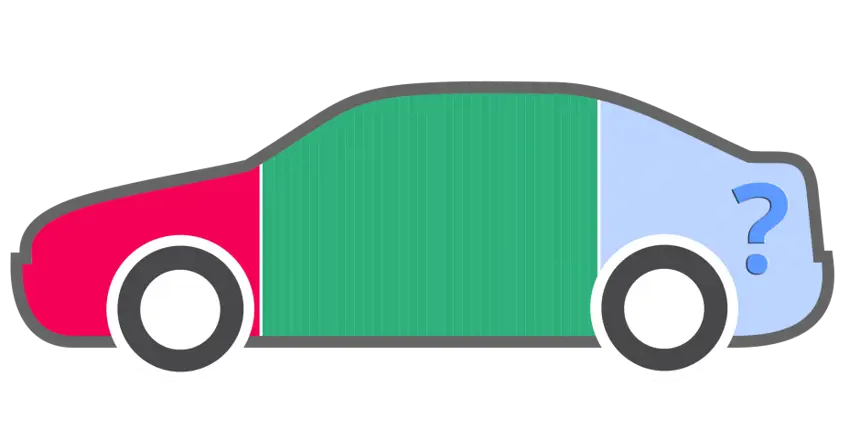

1. Deposit & delivery

- The larger the deposit, the lower your monthly payments will be.

- Low and no-deposit options are often available.

2. Monthly payments

- A fixed payment is due every month for the rest of the contract.

- Monthly payments only cover part of the car's value, keeping them low.

3. Choose

- Make the optional final payment or refinance it to keep the car

- OR Return the car with nothing left to pay

- OR Trade in the car for another vehicle

1. Buying a car at the end of a PCP

If you want to take ownership of the car, settle the finance by making the optional final payment and the car is yours. Once you've made the optional final payment - provided the deposit and all of the monthly payments have already been paid - you will become the owner.

Refinancing

If you want to keep the car but can’t afford to pay the full optional final payment, this can often be refinanced. Typically this means taking out a Hire Purchase contract. Bear in mind that this will mean you don’t own the car until you’ve made the last monthly payment on the Hire Purchase contract, though.

As this would be a Hire Purchase setup - rather than PCP - there is no large optional final payment needed at the end of the second contract.

Checks and charges

As you become the car’s owner by making the optional final payment with PCP finance, the condition and mileage of the car don’t matter - as you're not returning the car to the finance company - so there are no additional charges.

Selling the car

If the car is worth more than the optional final payment, you’ll probably be better off making this payment to buy the car - if you can afford to do so - and then selling it for a higher amount.

In many cases, you won’t have to find the money upfront because lenders are generally happy for you to sell the car at the end of the agreement - provided you check with them first and declare to any buyer that there is outstanding finance on the car.

It’s simplest to do this through a car retailer, as they can settle the finance on your behalf and return any surplus to you. Or you may be able to put it towards a deposit on another car if you want to trade it in for a new one.

2. Trading in your car at the end of PCP

By trading in your car at the end of a PCP contract, you can ensure a seamless transition from one car to another. Most dealers will be able to take your existing car, settle the finance on your behalf and set up a new finance arrangement to avoid any disruption.

It’s normally possible to arrange for a vehicle to be picked up on the same day that another is dropped off, so you don't have to worry about being without a car for any length of time.

Can you buy a car from a different manufacturer or retailer?

It doesn’t matter where you bought your current car or what badge is on the bonnet, you can trade it in for any other new or used car. This means that you needn't feel tied to a specific manufacturer. Any good dealer should be able to settle the finance on your behalf and arrange another finance agreement for your next model.

What happens if the car is worth more than the optional final payment?

If someone sells a car they own to a retailer or buying company, they’ll agree on a price and be paid in cash (or more likely a bank transfer). It’s the same story when you trade in a car at the end of a PCP contract, but there’s one extra step, as you don't own the car.

You’ll need to let the company buying the car know how much your optional final payment is and they’ll value the car. As long as their valuation is more than the optional final payment, then it’s a simple matter of them buying the car from the finance company and then you'll be able to take advantage of the surplus.

Instead of handing over the money to you, the company will settle the finance on your behalf by making the optional final payment to the lender.

Any surplus is then put towards a new car - where it can go towards the deposit on a new finance agreement, reducing the monthly payments - or you can choose for it to be paid directly into your bank account.

What happens if your car is worth less than the optional final payment?

In this case, trading your car in is a bad move. If no one will buy your car for the value of the optional final payment or more, then you would have to pay the difference between what you could sell the car for and the remaining finance balance, to ensure that the lender is paid enough to settle the contract.

Instead of doing this, you're better off by simply returning the car to the lender as you'll have nothing further to pay, provided the car's within the pre-agreed mileage limit and in good condition. The low value of the vehicle is then their problem.

3. Return a car at the end of a PCP

You’ll need to tell your lender that you are planning to return the car in plenty of time so that they can book an appointment to inspect and collect the car at a convenient time. You’ll need to make sure:

You have the original documents, including the V5C logbook and handbooks

All of the equipment is present, including the spare key, spare wheel and parcel shelf

The vehicle is clean and ready to be inspected outside in the light

The inspection may be postponed if the weather is too poor, or if it’s too dark to be able to conduct proper checks. If the car is dirty enough that it potentially obscures any damage, you may be liable for extra charges.

The car is assessed according to the industry standard fair wear and tear guidelines, published by the British Vehicle Rental and Leasing Association (see below for more). Your finance company will be able to provide you with a copy.

Damage or missing items will be marked on a checklist, along with the mileage. You'll need to sign this to confirm that you accept the findings. You'll be told within four weeks if there is anything more to pay. This can be disputed if you believe any of the charges are unfair.

Are there charges when returning a car at the end of PCP?

As PCP monthly payments are based on an assumption of the car's future value, anything you do that negatively affects this value could result in extra charges to compensate the lender for the value they've lost - if the car they receive back is worth less than it should be. This primarily means the following.

Excess mileage

At the beginning of any PCP contract, you'll need to agree to an estimated annual mileage figure. It's worth being as accurate as possible: the higher the mileage estimate, the more you'll pay each month because the car is likely to be worth less at the end.

If you underestimate the mileage and end up exceeding the agreed figure, you will find yourself with penalty charges, which can be as much as 30p per mile or even more in some cases.

Damage

As mentioned above, damage outside of the fair wear and tear standards is likely to result in end-of-contract charges. Charges vary between vehicles and lenders, but some alloy wheel scratches can cost more than £50 to repair, dented bumpers may result in a charge of £100 or more and windscreen chips are typically £20 or more.

Missing items

Missing documents or equipment will result in charges, whether it's a V5C logbook (typically you'll have to pay the replacement cost plus an admin charge) or an absent second key, which can cost more than £100 to replace.

What is fair wear and tear?

When purchasing a car finance, you agree to keep the vehicle in good condition throughout the term of the contract - because with PCP you don't own it unless you make the optional final payment to buy it.

Since the finance company owns the car, therefore, if you return the car covered in dents and scrapes, you can expect to be handed a hefty bill to fix the damage. Car finance companies expect the car to come back in a condition in line with its age and mileage and will accept any damage deemed to be fair wear and tear.

The British Vehicle Rental and Leasing Association 'Fair Wear and Tear' standard is used across the industry, detailing wear that is acceptable in a used car and damage that's not.

Inspectors take into account the age and mileage of the car, so older cars won't be expected to meet the same standard as newer ones.

Your finance company will be able to supply a full guide, along with any additional requirements and you should rely on these to work out whether your car's condition is acceptable or not. As an idea of what's included, general points include:

Windows and glass

✔ Chips as long as they have been professionally repaired, light scratching outside the driver’s field of view; replacement windscreen and headlights as long as, where fitted, the car’s 'ADAS' system - cameras and sensors that may be mounted behind the system and form part of the car's crash avoidance safety kit - has been recalibrated.

✘ Scratches and chips within the driver’s line of vision; damaged or cracked mirror and lights lenses; broken heated and adjustable mirrors; non-functioning heated screen.

Body

✔ Small paint chips providing they aren’t rusting; small dents providing the paint is not broken; light scratches that can be polished out; small scuffs and scratches on unpainted trim and wheel trims.

✘ Rust or evidence of poor paint and body repairs; large dents and deep scratches; marks left by stickers; broken unpainted trims.

Where fitted, a towing bracket should have been approved by the finance or leasing company and be in good condition with a tow ball cover in place. Convertible hoods should be free of damage. Vehicle underside and catalytic converters should be free of damage.

Wheels and tyres

✔ Tyres that are to car maker’s specification with tread depth that meets legal requirements; light scratching and scuffing of wheel trims.

✘ Corroded or damaged alloy wheels; dented wheel trims or wheel rims; used tyre inflation canister; incomplete or missing spare wheel and tools (where fitted to begin with).

Mechanical condition

✔ Car in a safe, legal and reliable condition that could pass an MoT test.

✘ Warning lights showing, grooved brake discs, faulty engine and gearbox.

Interior

✔ Light scratches and marks on treads, sills and seals.

✘ Holes, burns and tears on seats, trim and carpets, missing parcel shelf load cover and adjustable boot floor, missing nets and restraining straps, faulty media systems and missing SD cards.

When you sign a PCP contract, your monthly payments are affected by what the finance company predicts the vehicle will be worth at the end of the agreement.

That means that if you sign up for a high-mileage contract, the difference between the car's price new and its expected value at the end of the contract is greater, a high-mileage car will be worth less when the contract ends - increasing your monthly payments.

Similarly, if you return the car with large dents on every panel, scraped alloy wheels and torn seat fabric, the car will be worth less than expected - and the finance company will expect compensation for this. Finance quotes are based on the assumption the car will be returned in good condition with only minor - or fair - wear and tear, but if it isn’t, you will be charged for the cost of returning that car to that condition.

Damage charges are issued at the end of the contract if you decide to return the car to the finance company, as you do with a lease or PCP finance, where you choose not to buy the car outright.

At this point, you arrange to have the car inspected by the finance company that will record anything considered more substantial than fair wear and tear. Within four weeks you'll be notified what (if any) rectification work is required and how much you will be charged.

However, you can also face rectification charges indirectly when you part-exchange the vehicle. In this situation, the dealer offers to settle the outstanding balance with the finance company to clear the remaining debt and purchase the car outright.

If, due to its poor condition, the car is worth less than the finance company wants for it, you'll be asked for a top-up payment to cover its refurbishment before accepting it in part-exchange and paying off the finance company.

The best way to avoid being charged is to take care of your vehicle. If the car is handed back to the finance company in an acceptable condition, you'll be able to walk away without having to pay a penny more.

Where the car has picked up damage - whether these are substantial scrapes on bumpers from clumsy parking or large scuffs on the wheels - you may want to get quotes for putting these right.

In this scenario, you can contact the finance company to understand what they'd charge for rectifying certain types of damage and then you can see whether it'll cost you less to address any issues before the car is collected or simply pay any charges from the finance company.

How to avoid charges at the end of a PCP

Planning for the end of your PCP term may not be top of your weekend wishlist, but it's likely to be time well spent, as it could drastically reduce any charges you may be issued.

If your circumstances change and it looks like you're going to exceed your mileage allowance during your contract, then it's worth letting your lender know immediately.

They may be able to recalculate your future payments to take a higher mileage into account, ensuring that you're not left with a big bill at the end - though you will have slightly higher monthly payments instead. It should work out cheaper overall to change your mileage allowance than simply racking up many additional miles and being billed at the end.

Manufacturers recommend inspecting your car around 10 weeks before the end of the term, looking carefully at each panel and wheel in bright daylight to spot any scratches or dents. It may be cheaper to get any issues repaired yourself, rather than risking damage charges.

You're also likely to face charges for missing equipment, such as a spare key or documents. Finance companies typically add admin fees to the cost of replacements, which you won't have if you sort them out yourself.

Again, you may want to check the likely cost for any missing kit with the company to see whether you can source replacements for less yourself.