What is PCP car finance?

Fancy low monthly payments with the option to buy the car when the contract ends? Check out PCP finance - available for new and used cars

PCP (Personal Contract Purchase) is the most popular type of car finance and is increasingly being offered for used cars.

People are drawn to PCP deals because they offer fixed monthly payments that are lower than traditional car loans. A PCP gives you the option of buying the car at the end - if you make the large optional final payment. However, if you don't want to buy the car, you can hand it back and start again in a new car. Keep reading to understand whether PCP works for you.

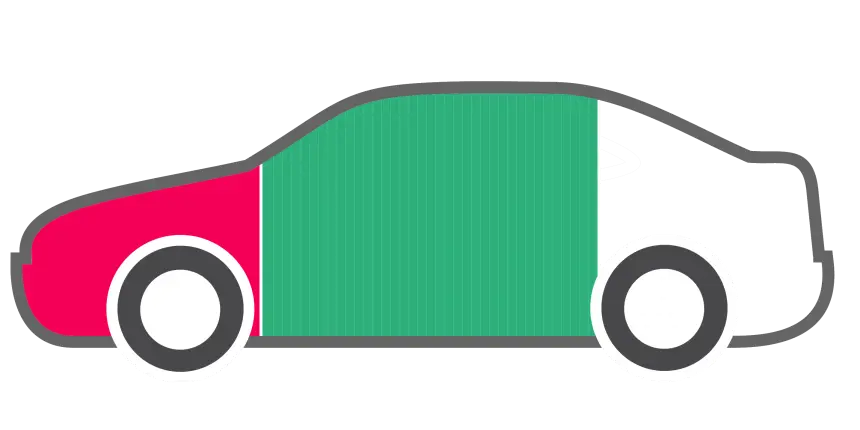

The deposit and monthly payments on a PCP deal essentially cover the value that the car is expected to lose during the contract term - the difference between the car's initial price and its predicted value at the end of the contract.

As a result, instalments for PCP finance are much lower than for an equivalent Hire Purchase (HP) deal with the same deposit and contract length. That's because HP monthly payments cover the whole value of the car and you automatically own it once you've made all those payments.

Meanwhile, with PCP finance, you'd need to make the large optional final payment when the contract ends, if you want to take ownership.

Since the optional final payment can amount to as much as half, if not more, of the car’s value at the start of the contract, it’s worth having an idea of what you’re going to do at the end of the contract - before you sign on the dotted line.

How PCP finance works

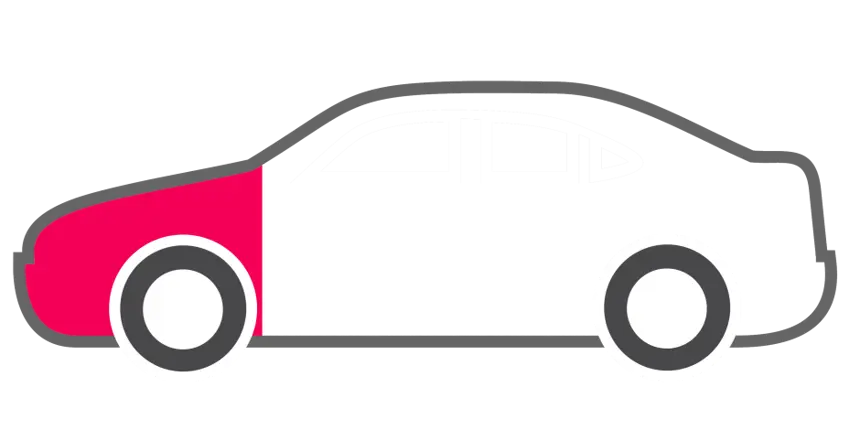

1. Deposit & delivery

- The larger the deposit, the lower your monthly payments will be.

- Low deposit or even no-deposit options are often available with PCP.

2. Monthly payments

- A fixed payment is due every month for the rest of the agreement.

- Monthly payments only cover part of the car's value, keeping instalments low.

3. Choose

- Pay the remaining balance or refinance to keep the car

- OR Return the car with nothing left to pay

- OR 'Trade-in' for another car if it's worth enough

PCP advantages

✔ Low monthly payments for the value of the car

✔ Range of options at the end of the contract

✔ Enables you to regularly upgrade to a new car

✔ You're protected if the car suddenly drops in value

PCP disadvantages

✘ You'll be charged extra for exceeding mileage cap

✘ Must keep car in good nick to avoid damage fees

✘ Not always available on cars over five years old

✘ More interest is charged than with equivalent HP

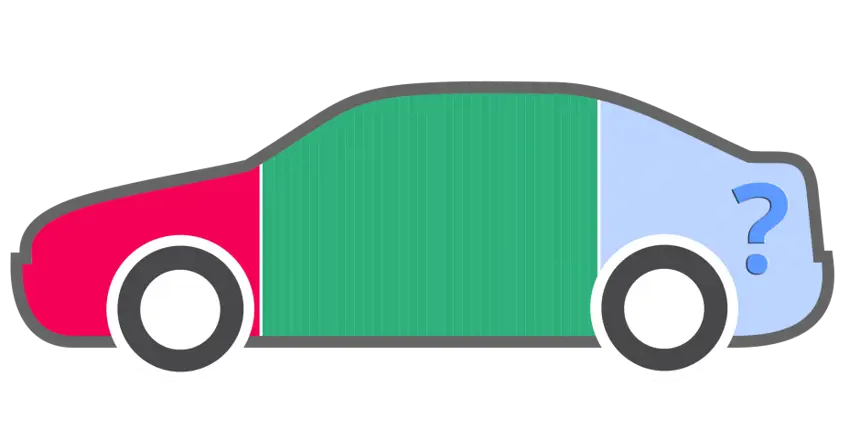

PCP finance deals typically last between two and five years. At the end, you generally have three options:

Hand the car back with nothing more to pay, providing there's no damage to the car beyond fair wear and tear and you've stuck to the pre-agreed mileage limit).

Buy it outright by making the final balloon payment or by refinancing the remaining balance.

Trade it in if the car's value is higher than the remaining balance on the contract, and use the extra value (known as equity) as a deposit on a new car to lower its monthly payments.

How are PCP finance payments calculated?

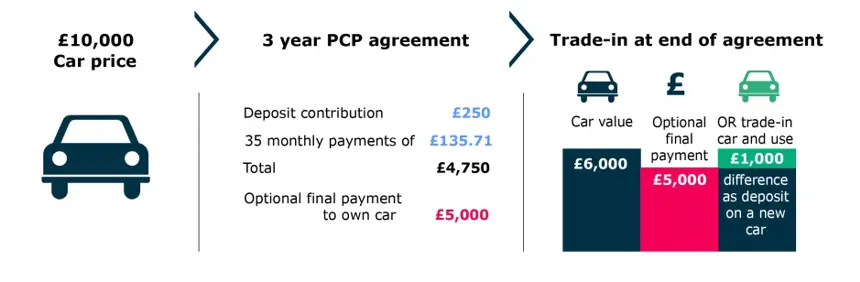

All of the payments in a PCP deal depend on the optional final balloon payment - also known as the guaranteed minimum future value (GMFV). This is an estimate of how much the car will be worth at the end of the agreement and is based on industry data.

The deposit and monthly payments then cover the difference in value between the car's initial price and the optional final payment - known as depreciation. You pay interest on all of the money that you borrow, though - including the optional final payment.

The fact the optional final payment is fixed means that you don't have to worry about the car losing more value than expected. If it's actually worth less than this estimate at the end of the agreement, then you can still walk away with nothing to pay (provided the car's in good condition and within the mileage limit).

The car is typically worth more than this final figure, giving you a safety net if the market drops. If the market stays stable then the car could actually be worth notably more than the optional final payment - the extra value is referred to as equity.

If your car has equity in it, you can then 'trade it in' for another finance deal, with the equity being put towards the deposit on your next car, reducing your future monthly payments.

What is a deposit contribution?

Deposit contributions are good news as they save you money whether you plan to hand the car back at the end of the contract or want to make what’s called the ‘optional final payment’ to buy it.

They are typically available on new car finance schemes, but can be found on a number of used car offers, too.

On £30,000 new cars, deposit contributions of £5000 or more are not uncommon. In some cases the deposit contribution can more than outweigh the interest charges. In those cases, it’s cheaper overall to buy the car through the finance scheme than paying the cash price upfront.

Do bear in mind, however, that deposit contributions aren’t taken into account in the APR figures shown, despite these claiming to show how much of a premium you’ll pay to finance the car. This means that drivers comparing finance deals must consider both the size of any deposit contribution savings as well as the APR charges.

A car with a £5000 deposit contribution and 4.9% APR charge, therefore, could work out cheaper than another with 0% APR - also known as interest-free credit - and no deposit contribution.

The easiest way to establish which deal is best for you is to get like-for-like quotes for the same type of finance, with the same deposit, contract length and mileage allowance, to see which offers you the lowest monthly payment.

The terms 'finance deposit allowance', 'dealer deposit contribution', 'retailer contribution' and 'manufacturer deposit contribution' are all other ways of referring to deposit contributions.

PCP finance with free insurance

Some car finance deals come with free insurance. This can represent an considerable saving - particularly for new drivers with little no claims bonus whose monthly insurance payments can be more than their car payments.

There are often minimum and maximum age limits with free insurance offers, so it's worth checking the specific terms and conditions to understand which deals are available to you.

Remember, though, that while car and insurance costs may be rolled into one monthly payment with these offers, going for a new car is likely to prove far more expensive than going for an equivalent used model and paying for your insurance separately. So, if you want the best value rather than sheer simplicity, this could be the way to go.

Can you get PCP finance on a used car?

PCP is available on new or used cars typically up to around four or five years old. In both cases, finance incentives may be available, including deposit contribution discounts. Opting for used car PCP finance can be one of the simplest ways to slash your monthly payments, with the lower cash price of used models meaning you’re borrowing less money.

PCP also involves smaller instalments than Hire Purchase would provide for the same car (assuming the same deposit, contract length, APR figure and availability of any deposit contributions), though you’ll pay more interest with PCP - as you’re paying off the balance more slowly.

Older cars are not normally available with PCP because it becomes difficult to predict their value at the end of the agreement, so the monthly instalments and optional final payment can't be calculated accurately. In these cases, Hire Purchase finance (HP) is usually offered, which spreads the total cost of a car across a series of fixed monthly payments.

How do I trade in a PCP finance car?

Instead of returning a car with equity in it and walking away, you can trade it in and drive away in a new model, making use of that extra value. This can cover some or all of your deposit, so there may be no need to dip into your savings, though you'll have lower monthly payments if you do put down a larger deposit.

It's important to remember that this isn't free money that's appeared out of nowhere - you’re simply getting back some of the money you paid in monthly payments that were based on a very cautious estimate of your car's future value.

If you’re looking to finance another car, then trading in is often a good option, because you can free up any equity in your car, without having to make the optional final payment to buy it beforehand. Do bear in mind that having equity isn’t guaranteed.

A particular risk is an economic downturn, when demand for cars may reduce. This will lower the value of used cars and may mean that your car is worth no more than the optional final payment. If that's the case, you'll have no equity in your car and you're likely to find that the same car would cost you much more per month next time around with no deposit.

Other car finance options

Hire Purchase is likely to be cheaper overall if you want to own a car outright. This is because the monthly payments are larger, meaning you're paying off the borrowing faster, reducing the cost of interest. With Hire Purchase, you own the car at the end, so if you plan to sell it in the near future, you’ll get less back for it if it suddenly loses value.

Leasing (also called PCH) may be the cheapest option for a brand new car if you know that you don’t want to own it. There’s no option to buy the car at the end of the contract, and it’s generally only offered with new cars, but it’s also one of the simplest formats because it’s effectively a long-term rental.

Yes. Whether you want a different car or are looking to reduce your monthly payments, you can end your contract early by requesting a settlement fee from the finance company. Once this fee is paid, you should owe nothing more to the lender. If you have the cash, you can simply pay it off and you'll own the car.

That's not an option for many people, so it is possible to sell or part exchange a PCP car with the agreement of your lender, who remains the owner of the car until the agreement is settled. This is normally arranged through a car retailer.

If you are near the end of the agreement, then your vehicle may be worth more than the settlement fee. In this case, most of the proceeds of the sale or part exchange will go to your lender. The remainder of the money will either come to you or be put towards your next car.

Should your vehicle be worth less than the settlement fee, then you'll need to pay the difference between the car's value and the amount owed to the lender.

You’re allowed to terminate your contract voluntarily once you’ve paid off half of what you owe (this means half of the total amount payable, including the optional final payment in the case of a PCP deal). Once you’ve done this, you can simply give the car back with nothing more to pay.

A word of warning, though. Because the total amount owed includes interest, fees and the optional final payment, you won’t get to this point until fairly late on in the agreement. In the case of cars that hold their value extremely well, you may not get to this stage before the end of the contract.

If you don’t want to wait this long, it is possible to use your voluntary termination rights by making a one-off payment that tops up however much you've paid to the 50% mark.

You can also repay your PCP agreement early. This typically saves you money in the long run on interest payments, but you’ll usually need to pay an additional fee that covers some of the interest that the finance company is missing out on.

One of the biggest benefits of a PCP agreement is that it offers total protection against a sudden and unexpected drop in car values. Once you've made all of your monthly payments, then you can just hand the car back with nothing more to pay, even if it's worth thousands of pounds less than the pre-agreed optional final payment.

However, an unexpectedly low valuation will limit your options at the end of a PCP agreement. If the car is worth less than the optional final payment, then you won't be able to trade it in. Instead you'll need to find the money for a deposit towards another car elsewhere, or opt for a no-deposit agreement and face higher monthly payments.

Buying the car also wouldn't make sense in this scenario as you'd have to make the optional final payment to buy it and this amount would be more than the car is worth. In this situation, you'd be better off handing the car back and buying a similar model that's for sale for a lower price.

One of the conditions of taking out a PCP agreement is usually that the car is covered by fully comprehensive insurance. This would ensure that any repairs are paid for.

If the car is written off, then the insurance company would normally pay out for the value of the car at the time. This would go to the finance company, which is the owner of the vehicle during the PCP term.

However, if the car has lost a lot of value soon after you bought it - which is typically the case with new vehicles - then it's likely to be worth less than the amount that you owe to the finance company. You would have to make this difference up, so you can take out GAP insurance to cover this.

GMFV stands for guaranteed minimum future value. It is a crucial part of every PCP finance agreement as it determines how much your monthly payments are going to be, as well as the ultimate cost of keeping your vehicle.

The guaranteed minimum future value is an estimate of how much your car will be worth at the end of a PCP finance agreement. The figure is calculated at the start of the contract and your monthly payments are then based on the difference between the price of the car and its GMFV.

At the end of the agreement, you'll have paid off the value lost by the car. You can then choose to buy the car for the GMFV or refinance it. Alternatively, return the vehicle with nothing more to pay.

The GMFV is also known as the balloon payment. It offers protection against a larger-than-expected fall in the value of your vehicle, because the lender guarantees the valuation. If the car is actually worth less at the end, you can still return it with nothing more to pay.

Lenders use industry price guides to estimate the value of your car at the end of a PCP agreement and this figure becomes the GMFV.

Your monthly payments are then calculated to cover the difference between the price of the car at the start and the GMFV, minus any deposit, so you only pay for the car's depreciation over the term - not the full price.

Choosing a vehicle that holds its value well will help to reduce your monhtly payments, as the GMFV will be proportionately higher. But because you defer more of the cost to the end of the agreement, interest charges will be higher.

Once the last monthly payment is made, the value of the car is normally similar to the amount you still owe (the GMFV). You can either make that final payment, or refinance it to keep the vehicle. You can also return the vehicle to settle the agreement.

You'll need to pay the GMFV if you want to keep you car. This can be done with a lump sum cash payment, or by refinancing the value. This could be in the form of another PCP deal, or a Hire Purchase (HP) arrangement, which would automatically make you the car's owner once the final payment has been made. You could also take out a bank loan to cover the cost.

It's generally wise to get your car valued by a car retailer or buying group before making your decision because it may be worth less than the GMFV.

If that's the case, returning the vehicle is often the best option, as your lender will take the financial loss. Instead of buying your car for the GMFV, you'll be able to buy a similar second-hand model for less.

You'll often find that your car is worth more than the GMFV at the end of a PCP deal because lenders err on the side of caution with their valuation estimates. If that's the case, then you may be best-off not returning the car, even if you don't want to keep it.

A popular option is to part exchange the car for another vehicle. The GMFV will be paid to the lender on your behalf by the car retailer and any remaining money can be put towards your next vehicle.

You could make the GMFV payment then sell the car immediately for more than you paid, leaving a surplus amount. This isn't a profit, but some of your monthly payments that you can recoup.

In most cases, you'll be able to sell the car with the agreement of your lender, without making the final payment. The proceeds will cover the GMFV that's owed to the lender and the surplus can be returned to you.

Lenders tend to be conservative when calculating the GMFV to reduce the risk of cars being worth less at the end. It does mean that you're frequently overpaying for the car because the monthly instalments usually add up to more than the depreciation. If you return the car, then that excess is pocketed by the lender rather than you.