What is Hire Purchase (HP)?

Hire purchase offers you the ability to buy your car outright with affordable monthly payments and no large final payment. We reveal all

Of all the different types of car finance, Hire Purchase (often abbreviated to HP) is perhaps the easiest to explain. In its most basic terms, you pay a deposit, then the balance is carved up into equal payments which last as long as the finance agreement - typically four or five years.

At the end, you’ll own the car and there’s no large final payment as is the case with PCP finance.

So why don’t more drivers use Hire Purchase? Quite simply, you’re paying the entire value of the car, rather than just the depreciation as you might on a PCP, which means that monthly payments can be much higher.

However, taking the longer view, those drivers who are looking to own the car once their finance contract ends will pay less overall than they would on a PCP. And there’s no large baloon payment, to ensure you fully own the car.

If you want to own the car you’re financing for the lowest overall cost - and are able to fund a significant deposit or absorb larger monthly payments - Hire Purchase could be the ideal option for you.

But if you’re driven by keeping the monthly payments as low as possible and don’t plan to keep the car for the long term, then other forms of finance, such as PCP or Leasing might be more suitable.

Hire Purchase advantages

✔ Spreads costacross monthly payments

✔ Less interest charged than with PCP equivalent

✔ No large final payment as with PCP if buying car

✔ Available on new and used cars alike

Hire Purchase disadvantages

✘ Monthly payments higher than with PCP

✘ You don't own car until final payment

✘ Higher instalments may limit your choice of car

✘ You lose out if value falls faster than expected

How does Hire Purchase work?

Hire Purchase splits the cost of a car across a deposit and a series of equal monthly payments for the length of the agreement. In that sense, it’s similar to PCP finance.

But where it differs is when it comes to the end. Hire Purchase doesn’t require a large final payment to keep the car. With HP, once you've made the last monthly payment, the car is yours.

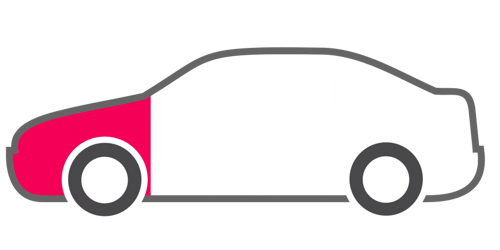

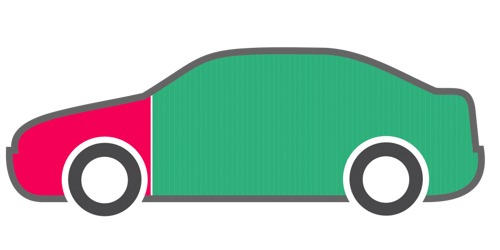

1. Deposit

- A deposit reduces monthly payments and interest charges. Low or no-deposit options may be available.

2. Pay monthly

- Pay for the remainder of the car with a series of fixed monthly instalments for the duration of the contract.

3. You own the car

- Once you've made the final payment, you become the legal owner and can keep or sell the car as you please.

Adjusting the amount of deposit you pay upfront and changing the contract length both affect your monthly payments. Paying more upfront will shrink your monthly payments and you'll end up paying less in interest overall.

Another way to cut the size of your monthly payments is to go for a longer contract. Though the longer the contract the greater the amount of interest you'll have to pay. Meanwhile, if you can't stretch to a substantial upfront payment, low-deposit and no-deposit Hire Purchase options are often available.

How are HP payments calculated?

It’s really simple. Over the course of the agreement you pay the full cost of the car, plus any interest, all split across a deposit, followed by a series of even monthly payments.

Therefore, if you put down a £1000 deposit on a £10,000 car, that would leave you with £9000 to pay, split evenly across the monthly payments. If you went for a three-year contract, that'd be £250 a month plus interest.

Some companies offer what is called a deposit contribution where the manufacturer or dealer pays something towards your deposit. This is effectively a discount and reduces the amount you have to pay. Low interest, or even 0% interest deals are also available on some cars.

Do bear in mind that some cars may have a large deposit contribution discount but high APR - meaning high interest charges - while others may not provide a deposit contribution but offer far lower interest charges and could cost you less.

Do I own the car with Hire Purchase?

As long as you make all of the monthly payments with Hire Purchase, then you will own your vehicle at the end of your contract.

Until then, the car remains the property of the finance company, so you won’t be able to sell it mid-contract, or modify it - by fitting a tow bar, for example - without the agreement of the lender.

This differs from PCP finance, as with PCP you don't own the car even if you have made all the monthly payments - you still have to pay the substantial optional final payment to buy it.

.jpg?width=759&format=webp)

HP vs PCP vs Leasing - which is best?

Whether HP, PCP or Leasing is best depends on whether you want to own a car and your personal circumstances.

If you’re not planning to keep your car at the end of the contract term, then Leasing or PCP (should you hand the car back at the end) will offer the most affordable monthly payments.

If you lease a car, you must give it back at the end of the contract and it's likely to prove harder and more expensive to end the contract early than with PCP or HP. Bear in mind that you have to return the car and keep within a pre-agreed mileage limit to avoid charges.

PCP finance offers a similar setup to HP in that you pay an upfront deposit followed by a series of monthly payments and can choose to hand the car back when the contract ends.

PCP is available for new and used cars, with the added flexibility of being able to make the optional final payment to buy the car for a pre-agreed figure.

Return the car at the end of the contract with PCP and - as with a lease - if you've exceeded the pre-agreed mileage limit or there is any damage beyond fair wear and tear to the car, you can expect to be charged extra for this.

At the end of a PCP, you'll have the option of 'trading in' the car and using any value over the remaining finance balance to put towards the deposit on your next car, reducing your monthly payments.

Both of these arrangements offer lower monthly payments than an equivalent HP deal because those monthly payments don't cover the full cost of the car. Unlike Hire Purchase, you don't automatically own your vehicle at the end and if you do want to buy the car with PCP you'll end up paying more interest as you're paying off the balance more slowly due to the lower monthly payments.

You shouldn’t assume that because PCPs offer lower monthly repayments than Hire Purchase that they’re the cheaper option. That’s because you’ll need to include the cost of the PCP optional final payment when comparing the two. Remember also that you'll pay more interest with PCP, as you're paying the balance off more slowly than with HP.

Can I cancel a Hire Purchase contract?

You can walk away early and hand the vehicle back with Hire Purchase but you’ll be left with no car to show for your payments. Depending on the value of the car at the time and the amount that you have repaid, you may need to make an additional payment, as for much of the contract - especially at the start - the car is worth less than the remaining debt.

There is an option called Voluntary Termination, set out in the 1974 Consumer Credit Act, which allows you to return the car without additional cost once you have made half of your payments. Half in this case means half of the total amount payable - that's half of the total of the deposit and monthly payments.

If you haven't yet got that far, then you can activate the Voluntary Termination by paying a lump sum that takes your total repayments to the halfway mark. Voluntary Termination would leave you with no car.

If you find yourself in a position to pay your contract off early, you'll own the car immediately and will usually pay less interest than if you had continued to make your monthly payments at the original rate. Your lender should be able to provide the total settlement figure at any point during the finance term.

Is Hire Purchase available on used cars?

Hire Purchase is available for new and used cars. If you're looking to keep a used car for a number of years, then HP could be the best option, as your deposit and monthly payments will cover the full cost of the car and you'll pay less interest overall than with an equivalent PCP finance deal. As you own the car at the end of the contract, you are free to keep it, sell it or trade it in for another car.

Monthly instalments are higher than with other types of finance such as as you automatically own the car at the end of the contract. If you want to own the car at the end of a PCP contract, however, you'll have to make the large optional final payment - and this could amount to half of the car's initial price, if not more.

If you chose to buy a car at the end of a PCP contract, therefore, you'd either have to find many thousands of pounds to make this payment or refinance this amount, increasing the total amount of interest you'll pay.

Hire Purchase is the most common type of finance offered on older used cars because it's simple for lenders to calculate on older cars where the future value of the car is uncertain.

The cost of the car (plus interest) is simply spread across a deposit and a series of equal monthly payments. This means there's no need for the finance company to attempt to estimate the car's likely value at the end of the contract - which gets harder the older a car becomes.

What are the best Hire Purchase deals?

There are often discounts and low interest deals available for cars purchased through Hire Purchase, which can help to reduce your monthly payments.

If you're buying a new car, then you may be offered a 0% APR deal, which offers substantial on paper benefits, because there's no interest to pay. This type of deal is rarely found for used cars, but low-rate HP finance should keep interest payments low, and in many cases a used car is likely to cost less per month than a far more expensive new car, even if interest is charged on the used model.

Be wary, however, that manufacturers or dealers that offer interest-free credit will typically not include the same discounts as those that charge interest, so the cash price could be higher.

Therefore, interest-free credit is no guarantee that you're getting a good deal. The best way to assess which deal is best for you is to get like-for-like quotes with the same type of finance, deposit and contract length - doing this should show which option offers you the best value.

If low monthly payments are your priority, then you can increase the deposit that you pay at the beginning of the agreement. This will reduce the total amount you owe meaning you’ll pay less each month. It also reduces the amount of interest that you pay because you are borrowing less.

You can also make your monthly payments more affordable by taking out a Hire Purchase contract over a longer term (four years instead of three, for example). Do bear in mind, though, that because you'll be repaying the money over a longer period, you will pay more interest over the course of the agreement, unless you have a 0% APR deal where no interest is charged.

GAP insurance covers the risk that you're left with no car and finance payments still owed, should the car be written off.

GAP insurance, stands for (Guaranteed Asset Protection) and could be useful for Hire Purchase agreements where you put down no deposit - or a small deposit - on a fairly new car. In these cases, the value of the car can initially drop quickly - far faster than the rate of your repayments.

If you are involved in a crash where the car is written off during this period, then the insurance payout would normally only cover the vehicle's value at that time.

If your car is worth substantially less than when you bought it, then you may find that there's a gap between the insurance payout and the amount that you owe the finance company. This can be covered by GAP insurance.

However, GAP cover is not always needed with HP. If you have a brand new car, then your comprehensive insurance cover will often replace your vehicle with a brand new car in the first year. After this, your deposit and repayments may well add up to more than the car's loss of value, meaning that there is only a small gap to cover, or no gap at all.

If you're buying a used car with a reasonable deposit of 10% or more, then your car may never be worth less than the amount that you owe with Hire Purchase, which would make GAP insurance unnecessary.

GAP insurance is more important with PCP finance than Hire Purchase because you're paying off the finance balance more slowly due the large optional final payment.

VT applies to both new and used cars that have been financed using PCP finance or Hire Purchase. To hand a financed car back early under Voluntary Termination, you must have paid at least half of the ‘Total amount payable’ on the finance. This includes not only the amount you borrowed, but all the interest and fees applied on top.

The 50% point is around the middle of a Hire Purchase contract, as you pay the debt off faster with this type of contract. This is because the deposit and monthly payments cover the whole value of the car with Hire Purchase and there's no large final payment left until the end.

While drivers using PCP finance and Hire Purchase have a legal right to end these finance contracts early in certain circumstances, many finance companies may try to prevent - or at least delay - you from doing this.

This is understandable, as VT costs them money as you’ll typically be handing a car back before you’ve paid enough to cover the value it has lost. And the longer a company prevents you from using Voluntary Termination, the longer you have to keep paying for the car.

Be aware, however, that one thing that may stop you from being able to use Voluntary Termination is if you’re behind with your payments. Consequently, if you think you may have to return your car early, make sure you start the process as soon as possible, as it’s important to ensure that you keep up to date with payments until you have terminated the contract.

Fail to do this and you could be pushed into handing the car back and still being liable for the remaining payments, through another mechanism for ending the contract early, which could make your financial situation much worse.

Not only should you not have additional charges to pay with VT, but there shouldn’t be any black marks left on your credit rating. Consequently, if you are having trouble affording the car, VT can be a sensible way to hand the car back early and make sure you don't get into debt or spiral into further debt.

Lenders will be able to see that you’ve handed a car back early, however, and some may refuse to offer finance to you again or charge you higher interest rates. That's especially the case if you’ve used VT multiple times - as the lender may fear you doing it again, before you’ve paid back what you owe them.

Unlike simply handing a car back at the end of a finance contract, no charges for damage above fair wear and tear can be charged when using Voluntary Termination.

This means that, as long as you’ve paid more than 50% of the total amount owed, you should be able to return the car without anything else to pay. Meanwhile, if you haven’t paid 50% yet, you can pay the extra amount to get to that point and be able to use the Voluntary Termination option.

Similarly excess mileage charges are not enforceable if you use VT. However, you can expect many finance companies to threaten legal action repeatedly in an attempt to reclaim the income they’ve lost through you cutting the contract short and/or damaging the car/having exceeded the pre-agreed mileage limit - as you would have broken the terms of the contract you signed.