Selling a car on finance

Want to end your finance deal early to get to a new car or because your circumstances have changed? Find out more about selling a car on finance.

The low monthly payments provided by PCP finance have made it the most popular type of car finance available in Britain. But what happens if you want to sell a car on finance?

In many cases, at the end of the finance contract the car is handed back to the finance company or bought outright by the driver by making the optional final payment. However, there are other instances where the driver might want - or need - to hand the car back early, perhaps to upgrade to a different model, or if they're struggling to meet their monthly payments.

Until you've made the optional final payment to settle the PCP contract, however, the car belongs to the lender, so you can’t simply advertise the vehicle and sell it whenever you like. This remains the case at the end of the term: until you have made that final payment to buy the car, it’s not yours to sell.

However, you are often able to sell the car with the agreement of the lender. Alternatively, you could part-exchange the vehicle for another one, using any value in the car above the remaining finance balance - known as equity - to put towards the deposit on your next car.

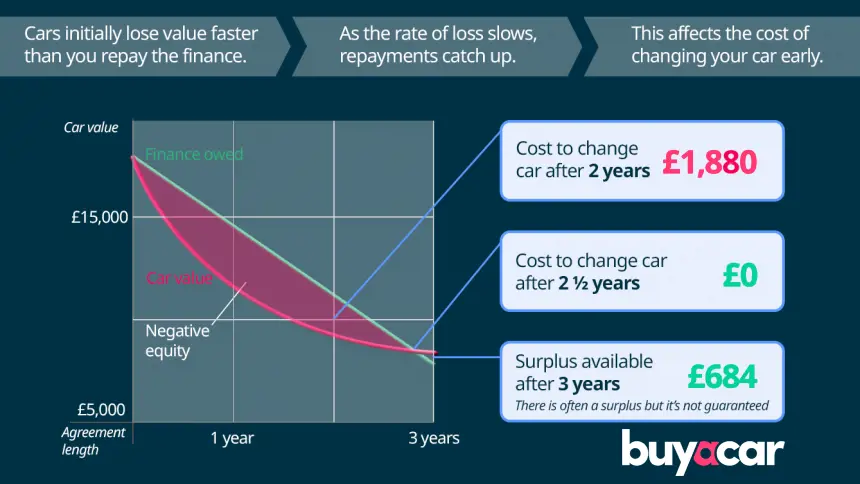

Early in a contract, the vehicle is likely to be worth far less than the remaining finance balance, meaning that even if you were to sell it, you're likely to still owe the finance company a substantial amount - potentially several thousand pounds.

When is the best time to sell a car on finance?

Whether selling your PCP car makes sense or not will depend upon how much you still owe on your finance contract (including the optional final payment) along with the current value of your car.

A car's value tends to drop steeply as soon as you purchase it, especially if it's a new model. Unless you put down a large deposit, this is likely to mean that you owe far more than the car is worth in the early stages of the finance agreement.

If you sell the car at this point, the proceeds are unlikely to cover your debt and you'll need to make up the difference. This is known as being in negative equity and is the same concept experienced with a mortgage when the value of a house drops below the amount of borrowing.

In contrast, at the end, your car may be worth more than the remaining finance balance. In this case, you can be left with some money once you've sold the car and paid off the finance balance, which many drivers put towards the deposit on their next car.

Selling a car on finance before the end of the contract

Ending a PCP contract early can be beneficial in the right circumstances. You may be able to reduce your monthly payments or change to different model that you like the look of. You’ll usually avoid paying most of the remaining interest on the initial contract.

However, in other circumstances, it may be an expensive move, as you’ll have to ensure that the lender is repaid everything that’s owed - the earlier you want to sell the car, the more you're likely to have to pay to leave the finance contract early. This can require you to raid your savings or go into more debt, so it's worth thinking carefully before taking the plunge.

Here are three ways to sell your car during the agreement, which have different pros and cons, depending upon your exact situation.

1. Selling a car on finance by part-exchanging it

A large proportion of car retailers deal with part exchange PCP finance cars daily, so you are almost guaranteed a smooth transaction if you’re looking to trade the car in for another one. You can do this at any time during the finance contract, but this can prove costly.

You’ll need to request a settlement figure from your lender. This is the total amount that you’ll need to pay to end the agreement early and take ownership of the car. It includes the remaining monthly payments as well as the optional final payment.

Towards the end of a PCP finance contract, a car may be worth more than the settlement figure. In this case, you should be able to part-exchange your car for a different one without too much trouble. Your finance will be settled by the retailer you’re buying your next car from. Any surplus can be put towards the finance on your next car.

When the settlement figure is higher than the remaining value of the car, you will have to pay the difference. This can be a one-off payment to the lender. Alternatively, you may be able to take out negative equity finance, where the difference is added to the finance on your next car.

Your monthly payments then cover both costs. Be aware, though, that this increases the total amount of interest you're paying and your monthly payments will be higher, as you're paying off the remaining cost of the first car as well as the full cost of the second one.

This doesn't apply if you're at the end of a PCP finance contract and the car is worth less than the optional final payment. In that scenario, you could return the car with nothing more to pay.

2. Selling a car on finance to a car buying company

Once you have your settlement figure, you may want to get a quote from a car buying company like Motorway, in order to see how much it will pay for the vehicle. It may be more than you're offered for a part-exchange.

Make sure you mention any damage to the car, which some firms are quick to use as a reason to dramatically cut the payout when you go to drop the car off. Do that and you risk a high valuation being slashed to a very low one, when you could have had got more elsewhere if you'd described the car accurately.

You’ll need the agreement of your lender to sell the car, since the car belongs to the finance company throughout the contract. The car only becomes yours if you pay off the finance early or make the optional final payment at the end. The car buying company will usually pay the lender what is owed directly.

If the car buying company gives you a valuation that’s higher than the settlement fee, this should leave you with surplus cash. If there’s a shortfall, however, you’ll normally pay the car buying company the difference between the car’s value and the settlement fee.

3. Selling a car on finance privately

Selling a car privately will often get you a better price than if you trade it in for another one or sell to a company. But you’ll have to manage the process yourself and get the express permission of the finance company to do so.

You'll also have to reassure buyers who are often wary of purchasing a car that has existing finance - as they could be chased for any outstanding finance on a car they buy.

Once you have the agreement of your lender, you can sell to a private buyer who will typically pay the lender directly. You’ll need to make up any shortfall to ensure that the lender receives the full settlement fee before the buyer gets confirmation that the finance has been settled and that they are the new owner.

If you agree to sell the car for more than the settlement fee, you will be able to pocket the difference.

Selling a car on finance at the end of the contract

Many drivers with PCP finance don’t even consider selling the car at the end of the contract, as the alternatives are much easier. Some return the car to the finance company. Others decide to buy the car by making the optional final payment that was set at the start of the contract.

Another popular option is to trade the car in. As cars on PCP finance are often worth more than the lump sum required to buy them when the contract ends, this can release money to put towards the deposit on another car.

If the car is worth more than the debt, then selling it should also release cash - perhaps more than if the car is traded in. You can either make the optional final payment and then sell the vehicle yourself, or sell it with the agreement of the lender just before the term comes to an end, as detailed above.

You'll have to decide whether the potential benefits - mainly getting more money for the car - are greater than any added hassle of selling the car yourself.